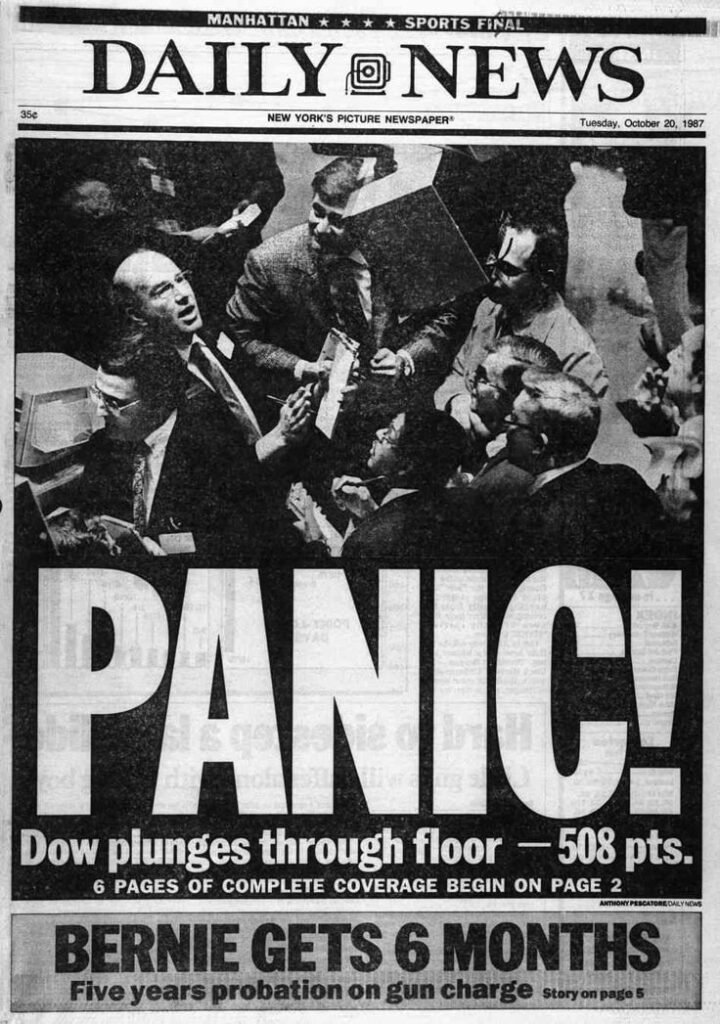

The Warning Signs We Pretend Not to See

A stock market crash is not just a graph dipping red — it’s the moment an entire financial system confesses it has been lying. Every expert says, “Don’t panic.” Every government says, “Everything is stable.”

But behind the curtains?

Corporations, billionaires, and political giants tighten their grip while everyday people prepare to get crushed under the financial avalanche.

When the market crashes, it’s not the wealthy who bleed.

It’s the common investor, the small business owner, the middle-class dreamer trying to save for a house, wedding, or education.

And yet, we are told, “Trust the system.”

Why a Stock Market Crash Is More Dangerous Today Than Ever

Technology Has Made Panic Instant

In the past, news traveled slowly. Today a single rumor on social media can wipe billions off the charts within minutes.

One tweet → global bloodbath.

One leak → mass liquidation.

One scandal → international chaos.

We live in a world where fear goes viral faster than facts.

Banks Are More Vulnerable Than They Pretend

Banks operate on confidence — not cash.

Your “savings” are mostly digital numbers.

When a crash spreads panic, withdrawals spike, loans freeze, and banks scramble to survive.

A market crash exposes just how fragile the financial world truly is.

https://salmon-hawk-329520.hostingersite.com/poseidon-god-mythology-explained

What REALLY Happens When the Stock Market Crashes

Horror Begins in Corporate Towers

Within minutes of a crash:

Massive companies lose billions

CEOs hold emergency calls

Workers face silent layoffs

Investors run like wildfire

And what do corporations do?

They cut jobs — not executive bonuses.

Your Savings Start Shrinking

Even if you don’t trade stocks, your:

Mutual funds

Retirement accounts

Insurance-linked investments

Pension funds

…all take a heavy blow.

The money you thought was “safe for the future” suddenly becomes a question mark.

Small Investors Get Hit First

Big whales manipulate dips, buy at the bottom, and use algorithmic trading to bounce back.

But the average citizen?

They lose months or years of savings in hours.

The harsh reality:

The system is designed for the wealthy to win and the common investor to panic.

The Economy Takes a Dark Turn

Jobs Start Disappearing Overnight

Businesses lose confidence.

Hiring stops.

Salaries freeze.

Promotions vanish.

Entire sectors shrink — especially:

Real estate

Retail

Manufacturing

Tech startups

Every crash creates a chain reaction that sweeps through the economy like wildfire.

Prices of Essentials Start Rising

Inflation can spike as:

Imported goods become costly

Companies reduce production

Currency weakens

Government debt increases

A market crash often becomes a cost-of-living crisis within months.

Loans Become More Expensive

Banks get scared.

Interest rates rise.

Home loans, car loans, personal loans — everything becomes harder.

The dream of owning a home? Delayed.

The plan to start a business? Shattered.

The ability to save money? An illusion.

Social Chaos: When Money Falls, Society Follows

People Start Revolting

History shows that economic collapse leads to:

Protests

Anger toward the elite

Distrust of government

Rise in conspiracy theories

Social media outrage

When money falls, so does peace.

Politicians Use Crises for Power

A market crash becomes a golden opportunity:

New laws get passed quickly

Taxes rise silently

Economic control tightens

Billionaires get bailouts

Citizens get slogans

They tell you it’s “for stability.”

But is it?

The Controversial Question: Are Crashes Engineered?

Who Benefits the Most From a Crash?

Follow the money:

Investment giants buy assets at dirt-cheap prices

Hedge funds profit from short selling

Corporations acquire dying competitors

Politicians justify new regulations

A crash looks like a tragedy for the public…

…but a discount sale for the powerful.

Market Manipulation Is No Longer a Theory

From insider trading to algorithmic triggers, the financial world hides more than it reveals.

Several crashes in history have shown patterns that look strangely… convenient.

Is every crash natural?

Or do some people pull the strings from behind the scenes?

The more you dig, the more uncomfortable the answers become.

What Happens After the Crash?

Recovery Is Never Equal

The rich bounce back quickly.

They buy stocks at the lowest point, build new companies, acquire land, and increase their power.

But for the middle class?

Recovery takes years.

Many never financially recover from a crash.

The gap widens, and wealth becomes more concentrated than ever.

New Rules, New Players

After every major crash:

New billionaires appear

Old corporations vanish

New industries rise

Governments restructure policies

A crash is not the end.

It’s a reset-button for the global financial order.

Could a Massive Crash Happen Again Soon?

Debt Is Higher Than Ever

Governments across the world are sitting on explosive debt.

One wrong move, one geopolitical shock, one banking failure — and it could all crumble.

AI Trading Could Trigger Chaos

Algorithms trade faster than humans can blink.

If multiple systems panic at once, we could witness the fastest crash in human history.

The World Economy Is Too Connected

When one nation falls, others collapse like dominoes.

We live in a world where:

A war

A single cyber-attack

A major bank failure

A political scandal

…can wipe out trillions in seconds.

Conclusion: A Crash Isn’t Just a Market Event — It’s a Global Earthquake

A stock market crash is not merely about money.

It’s about survival — economic, social, and political.

It reveals the truth we don’t want to face:

The world is built on an illusion of stability.

A crash exposes who really controls the system…

and who actually pays the price.

If the stock market crashes again, the shockwave will not stop at banks or businesses.

It will hit every home, every pocket, every dream.

The question isn’t “What if it crashes?”

The real question is…

“Are we ready for when it does?”